kentucky sales tax on-farm vehicles

SALES AND USE TAX The sales and use tax was first levied in its current form in 1960. This license is required for interstate carriers with a gross vehicle weight or a registered gross vehicle weight exceeding 26000 lbs.

Tangible Personal Property State Tangible Personal Property Taxes

650 Definitions for KRS 186650 to.

. For example an item that costs 100 will have a tax of 6 for a total of 106 100 times 06 equals. Exempt from weight distance tax in Kentucky KYU. The Governor said the abrupt adjustment warrants a.

Since Kentucky sales tax is simply 6 of the total purchase price estimating your sales tax is simple. 2022 Kentucky state sales tax. To calculate Kentuckys sales and use tax multiply the purchase price by 6 percent 006.

Or vehicles with 3 or more axles regardless of weight to. Kentucky Department of Revenue Division of Sales and Use Tax PO Box 181 Station 67 Frankfort KY 40602-0181. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

How to Calculate Kentucky Sales Tax on a Car. Are services subject to sales tax in Kentucky. The Kentucky state sales tax rate is 6 and the average KY sales tax after local surtaxes is 6.

For vehicles that are being rented or leased see see taxation of leases and rentals. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. Exact tax amount may vary for different items.

In addition to taxes car. Of course you can also use this handy sales tax calculator to. The property valuation for the average motor vehicle in Kentucky rose from 8006 to 11162 in just one year.

The state of Kentucky does not usually collect sales taxes on the many services performed but in 2018 passed laws broadening the base of. For Kentucky it will always be at 6.

Kentucky Sales Tax Exemption For Manufacturers Agile Consulting

Sales Use Tax Department Of Revenue

Ford Brothers Fall Farm Machinery Vehicles Equipment Recreational Vehicle Online Consignment Auction

![]()

Agriculture Gps Fleet Tracking Verizon Connect

Sales Tax Laws By State Ultimate Guide For Business Owners

Exemptions From The Kentucky Sales Tax

Northern Kentucky Equipment Verona Ky

10 Farm Tractor Salvage Yards In Kentucky 2021 Farming Base

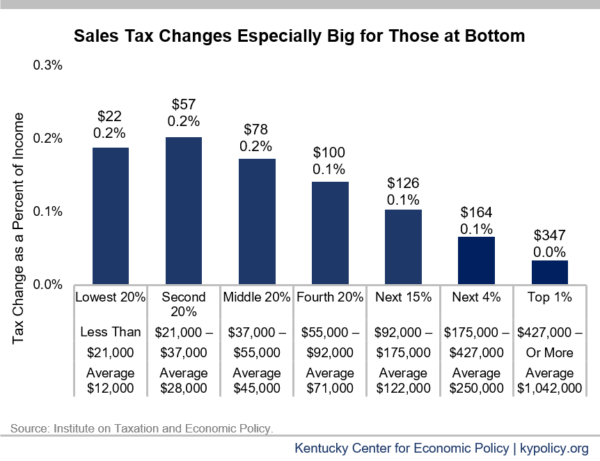

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Northern Kentucky Equipment Verona Ky

Agriculture Exemption Number Now Required For Tax Exemption On Farm Purchases Agricultural Economics

International Trucks For Sale In Kentucky 50 Listings Truckpaper Com Page 1 Of 2

Bill Seeks Higher Kentucky Gas Tax New Fees For Most Vehicles In Depth Wdrb Com

Answers To Common Agriculture Tax Exempt Questions Lifestyles Somerset Kentucky Com

Northern Kentucky Equipment Verona Ky

Agricultural Exemption Number Required For Tax Exempt On Farm Purchases Morning Ag Clips